Increasing efficiencies with AI

Insight Analysis

From jobs-to-be-done research, we learned that Underwriters would have to spend, on average, 87 hours each year, per person reading engineering reports to fully understand the risks they were insuring.

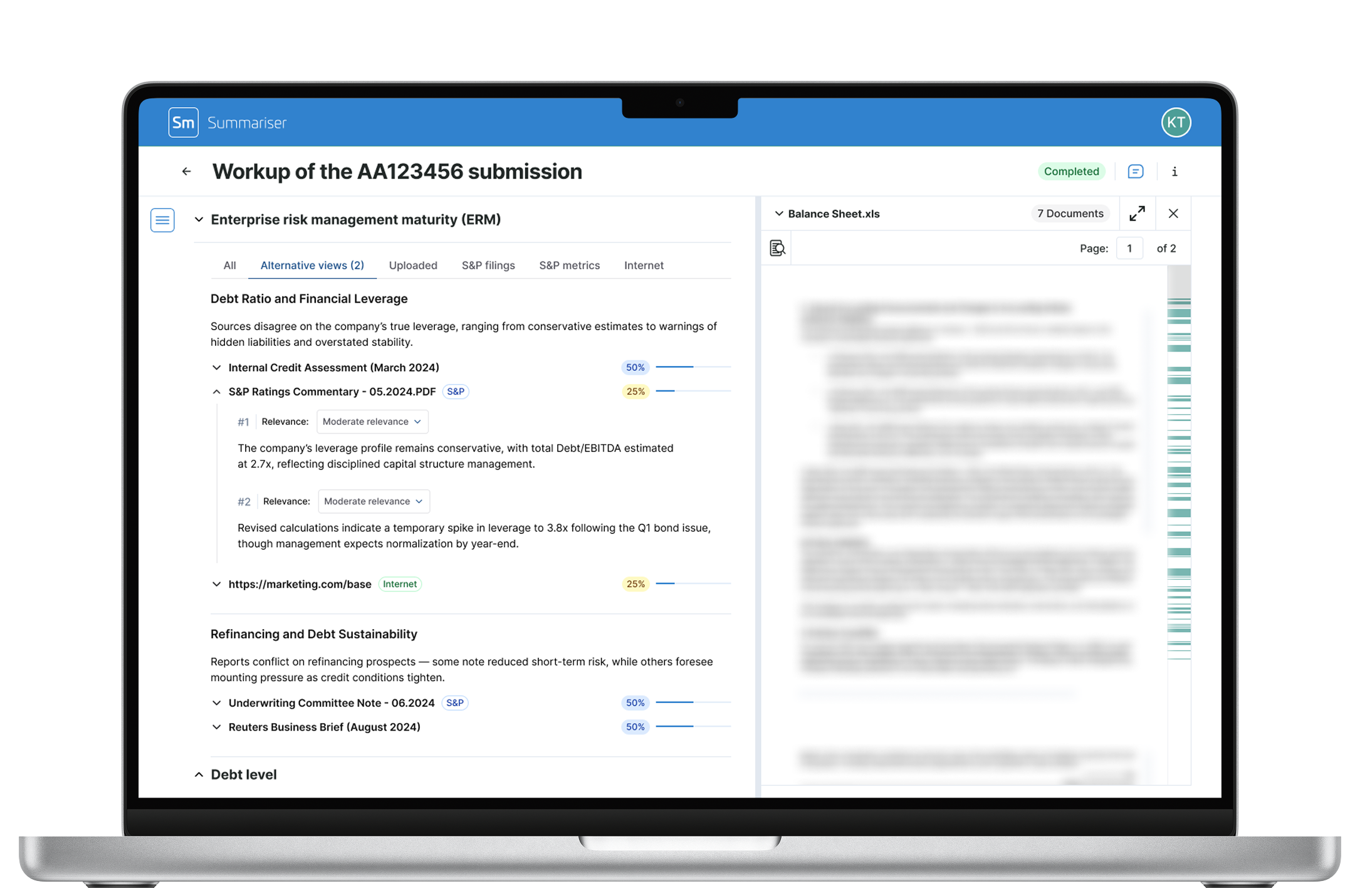

Our task was to build an AI service that would automatically extract reports from emails, analyse, integrate a human in the loop, and present the insights back to Underwriters.

We interviwed Underwriters using Cognitive Decision Making techniques, to understand what data helps them decide to take a Risk on or not. This was followed by the construction of a service that scans emails for reports, imports them into a summarisation tool, notifies the ‘unicorn’ which is our subject matter expert, and finally pushes them to Launchpad, our Underwriting Workbench, with a slack notification for the Underwriter to let them know it was ready.

The result was a decrease of 80 hours required per Underwriter each year to consume insights from engineering reports, and a 90% increase in report insights reviewed by Underwriters.

Integrating online news sources offers alternative views of the reporting to give a full 360 image of the Risk

Structured data from external APIs such as S&P are brought in to compare client filings to documents submitted to the Insurer